County to examine drop in sales tax

Published 1:13 pm Monday, January 23, 2017

By Dawn Burleigh

The Orange Leader

Texas Comptroller Glenn Hegar announced he will send cities, counties, transit systems and special purpose taxing districts $647.4 million in local sales tax allocations for January, 4.9 percent more than in January 2016. These allocations are based on sales made in November by businesses that report tax monthly.

“The cities of Dallas, Fort Worth, Austin and San Antonio continue to see significant increases in sales tax allocations,” Hegar said. “The cities of Houston and Sugar Land saw noticeable decreases in sales tax allocations.”

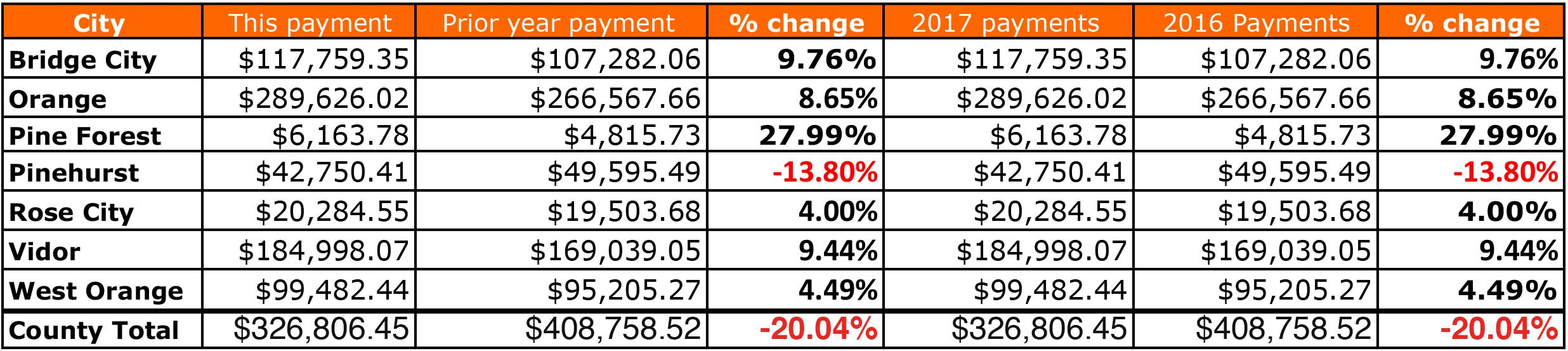

While the sales tax revenue was an increase for most of Texas, Orange County saw a drop of 20 percent.

“We are going to look into the driving force behind the decrease,” County Judge Stephen ‘Brint’ Carlton said. “It is a reason for more people to shop locally.”

Sales tax is one way to increase revenue for the county. The other part of the equation is property tax.

Shopping locally generates sales tax, which provides police and fire protection, improves road and bridges, and improves parks and recreation facilities. In turn, these benefits improve the quality of life for residents.

Increasing sales tax, by shopping locally, can lead to a decease in property tax while reflecting citizens supporting the community.

The City of Pinehurst also saw a 13.8 percent decrease in sales tax revenue for the same period.

Pine Forest had the greatest increase with 27.99 percent compared to this time last year.