Nichols cautions local governments against raising property taxes

Published 12:59 am Wednesday, July 29, 2020

|

Getting your Trinity Audio player ready...

|

As a former mayor and city councilman, I understand firsthand the challenges that are presented when balancing a budget – in good times and bad. Currently, as a Senator and a member of the Senate Finance Committee, I have the honor of working to ensure the state is responsibly allocating the taxpayers money, and being a good steward of its resources.

During the 86th Legislative Session, I co-authored and helped pass Senate Bill 2, which lowered the amount by which city and county revenues can increase to 3.5 percent per year. Prior to this law being enacted, city and county budgets could increase by as much as eight percent each year, without seeking voter-approval.

One provision in the law created an exception for local governments if a disaster declaration had been issued by the Governor of Texas. Some counties and cities have interpreted this provision to apply to both physical disasters, such as Hurricane Harvey, and financial disasters, such as an economic downturn.

Attorney General Ken Paxton has issued a formal opinion, in which he states, “A court would likely conclude that the Legislature intended to limit the temporary tax exemption to property physically harmed as a result of a declared disaster. Thus, purely economic, non-physical damage to property caused by the COVID-19 disaster is not eligible for the temporary exemption provided by Section 11.35 of the Tax Code.”

As a co-author of this bill, I whole-heartedly agree with Attorney General Paxton’s findings. Nobody could have ever foreseen a global pandemic which has resulted in a statewide disaster proclamation, when Senate Bill 2 was passed. Texans have lost their jobs and are hurting financially because of the global pandemic. This is not the time to raise their property taxes, when the current economic crisis has hurt so many families already.

This is the time to tighten our belts, and limit unnecessary expenditures. That’s what the State of Texas, local businesses and families across Texas are doing. I believe local governments must do the same, or risk facing the consequences of fighting this battle. A legal fight to raise property taxes, could cost taxpayers and communities even more of their hard-earned money.

In these uncertain times, Texans must work together and for each other to ensure our economy and our beautiful state comes out on top, as we work through the economic struggles brought on by this unforeseen global pandemic.

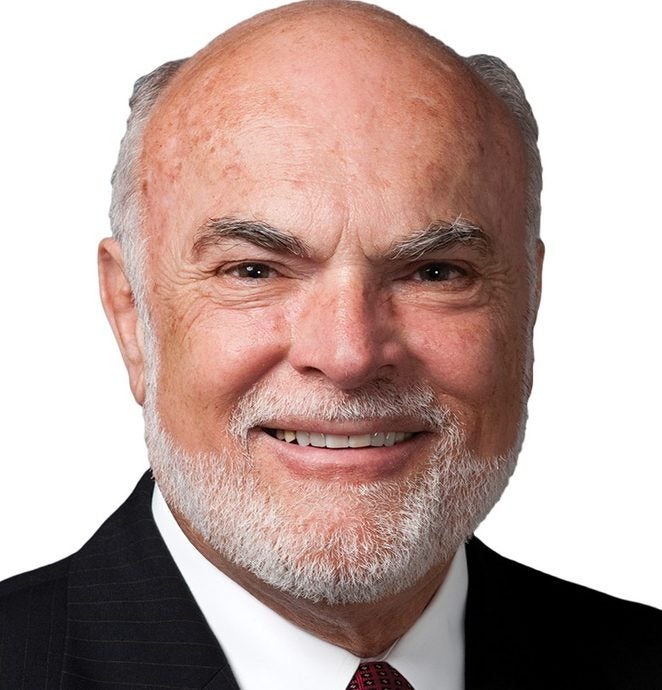

Robert Nichols is the Republican Senator for the 3rd District in the Texas Senate.