Bearing too much of the burden

Published 6:16 pm Saturday, October 12, 2019

We constantly hear how high property taxes are – and for good reason! Of all the taxes collected in Texas, property taxes account for over 50%. Can’t we shift some of the burden from property taxes to other taxes such as sales, bed, severance, gas or others? If so, how and more importantly who can make these changes happen?

Why taxes at all? Police, fire, public education, roads and bridges, water, trash, courts, elections, parks, senior centers, and many other services provided by state and local governments are funded by taxes as well as by certain fines and fees.

You should also know and be proud of the fact that according to the Tax Policy Center, when we take the total of all state and local taxes collected as a percentage of our personal income, Texas ranks 37th among the 50 states. The low cost for the high quality of life services provided by our state and local governments is just another reason why folks are moving here from all over the country.

Now to taxes. Our State Legislature decides which taxes can be used to pay for what services. Hospital districts, community colleges, counties and special districts are allowed to collect property taxes to pay for the services they provide. Schools also use property taxes to pay their local share, while the State uses the taxes it collects to pay its portion of public education. Cities are permitted to use a limited amount of sales and hotel occupancy tax (HOT) and property taxes to pay for the services they provide. The one tax we don’t collect and never should is an individual state income tax!

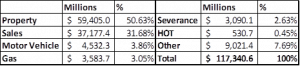

Total state and local tax collections by type for 2017 were as follows:

It’s easy to see property taxes are bearing too much of the overall burden.

Property and severance taxes are paid only on personal and real property in Texas, while most other taxes are paid for goods and services purchased by anyone living in or visiting our state.

Gas taxes have not been adjusted since 1993 and are still not indexed for changes in the price of a gallon of gas. But at least they are paid by everyone buying gas in Texas, even visitors from other states or those driving through our state pay a portion of this type of tax.

Please encourage our legislators to increase those taxes which are at least partially paid by people who visit or drive through our state. Ask them to consider allowing local governments to reduce property taxes by authorizing them to collect other types of taxes.

While we are 37th in taxes collected to pay for government services, property taxes are bearing too much of the burden. As we approach the upcoming election season, make this an issue and find out where the candidates stand. It’s time for property taxes to come down!

Glen Whitley is Tarrant County Judge